Are you jealous of those who earned a fortune on Forex? Read our article "How to trade Forex with $100 for any trader" to get an in-depth study of how the forex market works.

In this article, we will tell you what you need to enjoy your trading experience and generate profits.

Cold facts about Forex

Every trader who comes to the forex market aims to increase their deposits. They will want to gain as much profit as possible with the least losses.

Apparently, you cannot gain profits without bearing losses. However, one can make up for losses using wise trading strategies.

Simply put, beginners should clearly understand that they cannot avoid losses when trading Forex. The main thing is to generate profits that exceed the losses.

It all depends on trading skills, experience, knowledge, and trading instincts.

In addition, traders should have a working trading strategy as well as stay focused and react to market changes. Besides, emotions are not traders’ best friends. It is important to stay sharp and adjust to market movement when trading.

Among other important points, traders should know when to enter the market and when it is time to close positions to avoid considerable losses. Finally, it is not recommended to trade against a trend.

Anyway, these are some takeaways that may help you minimize losses. We will talk about gains and losses in more detail below.

How to trade Forex without losses

Experts note the following cornerstones of successful trading on Forex:

- wise capital management

- basics of trading psychology

- financial flows analysis

Let’s talk about them in more detail.

Traders should have a thoroughly planned trading strategy to manage their capital.

In other words, you should have a number of principles and adhere to them when trading unless you will want to practice gambling on Forex.

Then you need to choose a currency pair and decide whether to buy or sell it. However, it is not everything you should do.

First of all, you need to make sure that your strategy solves two problems. The first is to identify the trend as early as possible, and the second is to filter out false signals.

Your behavior in the market should be based on this principle. Thus, you enter the market at the right time according to a trend and do not pay attention to deceptive signals.

When shaping your trading plan, you should consider the following:

1. The initial capital you can trade with.

If you are a beginner, start with $100-$150 as long as it is not the last money in your wallet.

2. Time you can spend on trading. Decide on how many minutes or hours you can devote to Forex and how often you want to see your trading results.

Depending on your own preferences, you can choose long-term trading or intraday trading.

Hence, there are different time frames.

3. Indicators that help monitor market changes. You can choose among trend indicators which make it easier to define a market trend as well as oscillators, and other indicators.

Oscillators show the rate of price change over a certain period. As a rule, they are used in combination with other indicators.

There are a lot of indicators you can make use of. Here is a list of some of the most popular ones:

- Bollinger Bands

- Fibonacci levels

- Moving averages

4. Risks. We have already said that forex trading can’t be imagined without losses.

It is important to determine your loss tolerance and you can use Stop Loss orders for this reason.

Stop Loss orders close positions when the price reaches the level you set.

5. Entry and exit points. If you want to earn on Forex, you should decide on whether to buy or sell the pair and find good entry and exit points.

To make opening positions easier for you, use the following:

- Trend. If you see an uptrend, open a position at the lowest level possible. On the contrary, if the trend is downward, you will want to open positions at higher levels.

- Support and resistance. When the price approaches these levels, this indicates a perfect time to enter the market. You can buy the pair when the price is nearing support and sell it when the price is close to resistance.

- Pivot points. At these points, the trend is reversing. It is better to open positions when the price hits pivot points.

Before you open a trade, make sure you have found the right exit point. It is important what period you have chosen for trading. You may use scalping or long-term trading. You should be ready to use Stop Loss orders to prevent losses if a trend reversal occurs.

6. Currency pair. You should be careful when choosing currency pairs for trading. Sometimes traders make a mistake trying to earn a fortune with highly correlated currency pairs.

For example, some indicators demonstrate that you can earn by selling the euro against the US dollar and the Swiss franc. At the same time, you may buy the euro against the pound. These trades are opposite but here you bet on the strengthening of the euro.

The way this plan is highly doubtful.

Notably, every trading plan should be applied to one trade. Thus, if the euro is strengthening against one currency, it does not mean you should buy it against other currencies.

7. Leverage. Trading with borrowed funds may multiply your potential income but risks increase considerably as well.

Investors should go through these stages before they start to trade. If it seems difficult by now, you can practice on a demo account, which almost all brokers offer.

Popular trading strategies

There are a lot of trading strategies as well as their classifications in the forex market.

Let’s have a look at the most efficient strategies. They do not guarantee you will earn a fortune on Forex but can make your trading more effective.

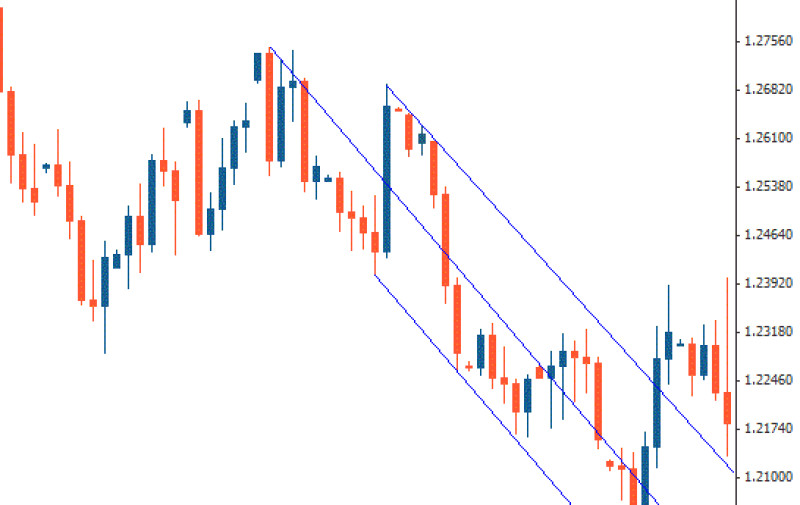

- Andrews' Pitchfork. It represents three parallel trend lines that look like a pitchfork. The lower trend line identifies a support level and the upper line is a resistance level. Between these two lines, there is a middle line.

This trading strategy implies establishing pivot points in relation to the median line. As a rule, when the price bounces from the lower or the upper lines, it indicates possible entry points according to a trend

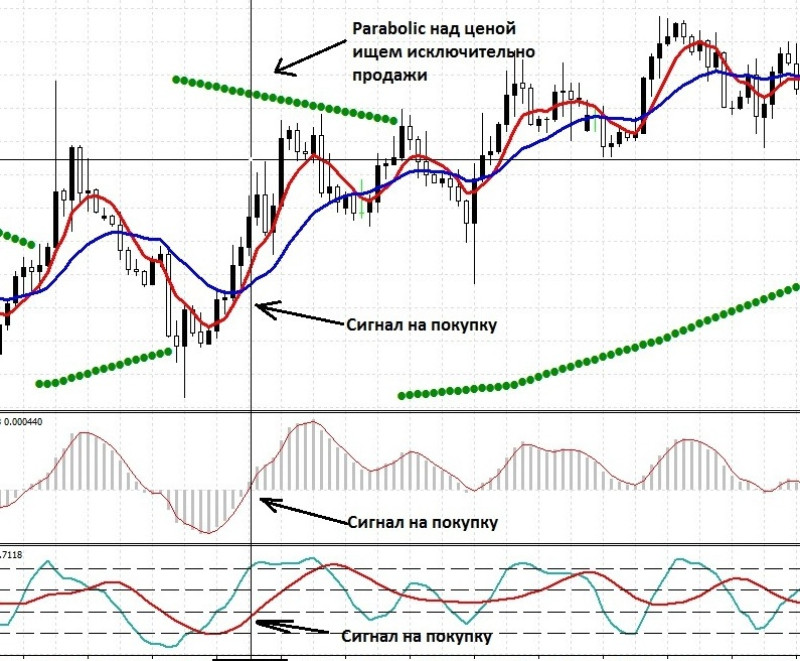

- Forex Smart. It includes a set of indicators and oscillators. These are moving averages, the Parabolic SAR, the MACD index, and the stochastic oscillator.

When they give a signal, you can open positions

- 4-hour chart. The MACD indicator plays a major role in deciding whether to open or close a position on the 4-hour chart.

When the Moving Average Convergence/Divergence indicator crosses the zero line, it gives a signal to buy or sell a currency - Find precise entries. This strategy requires several indicators and oscillators as well as Take Profit and Stop Loss orders

When the RSI and the stochastic oscillator enter the oversold or overbought zone, it gives a buy or a sell signal - Scalping and MAs. You can make trading decisions when the EMA20 and EMA50 cross. You can open long positions if they cross each other to the upside, and open short positions if the direction is opposite

Break-even rule

Savvy traders usually do not share their successful strategies. However, there are several rules you need to follow.

For example, the 2% rule reads that a potential loss of each trade should not exceed 2% of your total balance.

Imagine that you have $100 on your account and you want to open a position using all of that money. In this case, your losses should not exceed $2.

If the risk is higher, you may bear more losses which can lead to disappointment. After all, you should understand that to restore the original amount on the deposit, you should gain profits that exceed the losses.

For example, if you lose 10% of the money in your account, you will need to make a profit of 11.1% to recoup the losses.

How much money to recoup to reach a break-even point

| Loss | 5% | 15% | 25% | 45% |

| Amount to recoup | 5.3% | 17.6% | 33.3% | 81.5% |

Besides, the potential profit should be twice as much as a possible loss. That is, if the risk is 2 points, the expected profit should be at least 4 points.

Traders should save their deposits every time they trade to be able to trade in the future. Simply put, they should ensure they have a certain amount of money today to be able to trade tomorrow.

For this reason, it is important to set loss limits for a certain period. For example, set loss limits for a day, a week, a month, etc.

It is just as important to be disciplined in trading, as scary as it may sound. It means strict adherence to your trading plan.

Many traders, especially rookie ones, admit that after making several profitable trades in a row they may fall into gambling. To earn even more, they open new trades, sometimes against their trading plan.

As a result, traders may lose all their profits or the entire deposit.

You should understand that trading is not a game of chance or gambling. Your self-control plays a significant role in trading.

The analysis of your trades is also crucially important. It allows you to draw conclusions about your trading plan and adjust it if necessary.

Example of a trading performance analysis

| Total trades | 140 |

| Profitable trades | 40 |

| Unprofitable trades | 100 |

| Average profit | 50.1 points |

| Average loss | 14.9 points |

| Total points gained | 2,050.7 |

| Total points lost | -1,542.1 |

| Most profitable trade | 55.3 points |

| Most losing trade | -18.9 points |

| Average trade performance | 3.9 points |

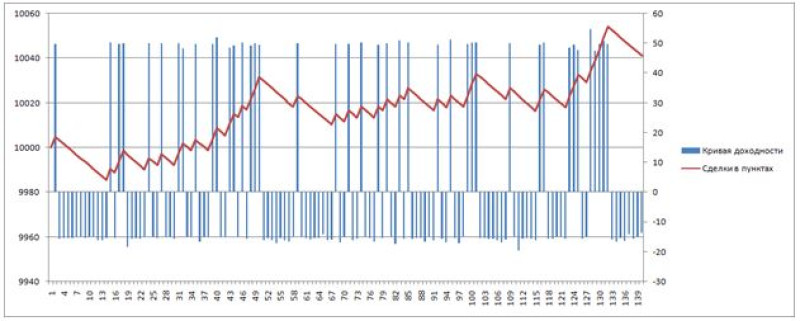

Considering the table above, the trading plan bears 1.3 points of profits. The analysis shows that only one out of three trades is profitable, but the size of the profit exceeds the losses.

The longer the time used for analysis, the more accurate the conclusions.

Another rule of thumb is to be able to see losses as an integral part of trading on Forex. No strategy would provide winning trades only.

The yield curve tends to go up as well as down. This can be seen in the chart for the strategy we discussed above.

Finally, it is important to efficiently manage your Stop Loss orders. You can move a Stop Loss to reduce risks but never to increase them.

If you move a Stop Loss order to break even, that would be the right decision to close a position.

Risk management

It is important to manage the risks to ensure that Forex trading does not lead to losses. At first glance, it may seem that strict limits not only save you from significant losses but also limit your profits.

However, trading without risk management looks like a lottery.

Without double-checking signals and Stop Loss orders, the result of trading will depend solely on pure luck. In addition, your knowledge and skills that are fundamental to trading are no longer needed in that case.

According to studies, dozens of profitable trades give more information about the market than hundreds of trades performed in the heat of the moment.

To master the art of trading without losses it is important to

- minimize costs;

- follow the rules for opening a position and maintaining it;

- improve the chosen trading plan over time.

This can only be achieved by following the rules that we described in this article.

In addition, the following tips will help you improve your stamina in the forex market:

1. Bring your emotions back to a normal state. If you're overreacting, postpone entering the market until a more favorable psychological state of mind arrives;

2. Make adjustments according to global economic events and news. Practically, traders become more active when some important event happens, which means that the risks are also increasing.

In order not to miss anything important, make it a rule to keep track of events in the economic calendar;

3. Stick to your trading plan. Even if you break your own rules and a performed trade occurs to be profitable, it is not a guarantee of a similar result in the future;

4. Manage your deposit. Here we are talking about the 2% rule;

5. You should always plan not only your entrance but also your exit from the market.

Conclusions

You can find many examples on the Internet describing how people not only solve their current financial problems with the help of Forex but achieve impressive success. Some tells that trading helped to buy an apartment, someone a car.

It is difficult to check whether such stories are true or not. However, one thing is certain: it is not necessary to make Forex your full-time job.

Forex trading involves risks. The only way to avoid such risks is not to trade.

Behind the success of any experienced market player, there is hard work and skills developed over months and years.

Read more:

What is trading with leverage and how to use it effectively?

Back to articles

Back to articles